Tag: tax

Understanding Tax Debt Resolution: The Role of IRS Tax Relief Programs

- by Emilie Albury

- 2 years ago

- 0 comments

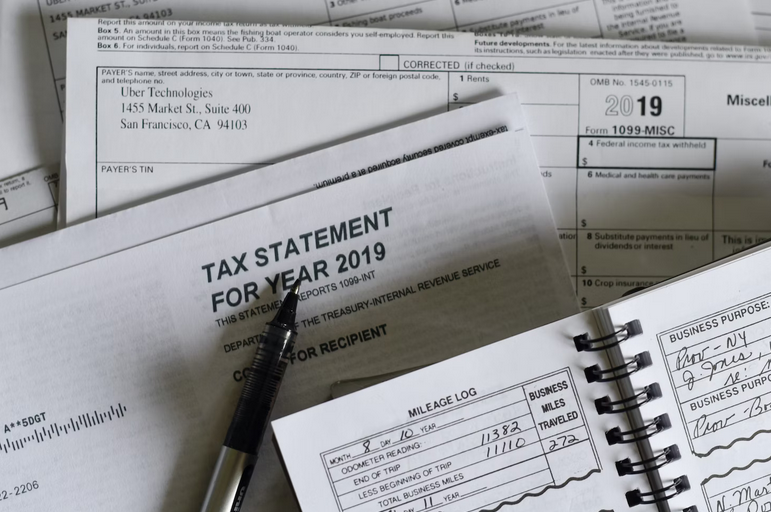

Tax debt can be a daunting burden for individuals and businesses alike, leading to financial stress and uncertainty. However, the Internal Revenue Service offers an IRS forgiveness program designed to help taxpayers resolve their tax debt and regain financial stability. In this article, we will explore these IRS tax relief programs and their vital role in assisting taxpayers in times of financial hardship.

Offer in Compromise (OIC)

The Offer in Compromise program is one of the most well-known IRS tax relief programs. It allows eligible taxpayers to settle their tax debt for less than the full amount owed. To qualify, you must demonstrate that paying the full amount would cause financial hardship or be unjust. The IRS considers factors such as your income, expenses, assets, and ability to pay.

Installment Agreements

Installment agreements provide taxpayers with a structured plan to pay off their tax debt over time. These agreements allow you to make regular monthly payments, making it easier to manage your financial obligations. The IRS offers various types of installment agreements, depending on the amount you owe and your financial situation.

Innocent Spouse Relief

Innocent Spouse Relief is designed to protect individuals who may be held responsible for their spouse’s tax debt. If you can prove that you had no knowledge of your spouse’s tax errors or omissions, you may qualify for relief. This program helps innocent spouses avoid unfair tax liability.

Currently Not Collectible (CNC) Status

If you are facing financial hardship and cannot afford to pay your tax debt, you may be eligible for Currently Not Collectible status. This temporarily suspends IRS collection efforts until your financial situation improves. While in CNC status, the IRS will not attempt to collect the debt but may still accrue penalties and interest.

Tax Liens and Levies Resolution

IRS tax relief programs also address tax liens and levies. A tax lien is a legal claim against your property, while a levy allows the IRS to seize your assets to satisfy a tax debt. The IRS offers options to release or remove tax liens and stop levies, such as entering into an installment agreement or demonstrating financial hardship.

Fresh Start Initiative

The Fresh Start Initiative is a collection of IRS tax relief provisions designed to make it easier for individuals and businesses to resolve their tax debt. It includes more flexible criteria for Offer in Compromise, streamlined installment agreements, and increased thresholds for tax liens.

Tax Relief for Disaster Victims

In times of natural disasters, the IRS provides special tax relief programs for affected individuals and businesses. This relief may include extended filing deadlines, penalty waivers, and assistance in reconstructing lost tax records.

IRS tax relief programs play a crucial role in helping taxpayers resolve their tax debt and regain financial stability. Whether you are struggling with a substantial tax debt or facing unexpected financial challenges, it’s essential to explore the options available to you. Consulting with a tax professional or seeking assistance from the IRS can help you determine the best course of action for your specific situation. Remember that proactive communication with the IRS is often the first step toward finding a suitable tax debt resolution plan.…

Read More