Tag: credit card

How to Improve Your Credit Score Using Credit Cards

- by Emilie Albury

- 6 months ago

- 0 comments

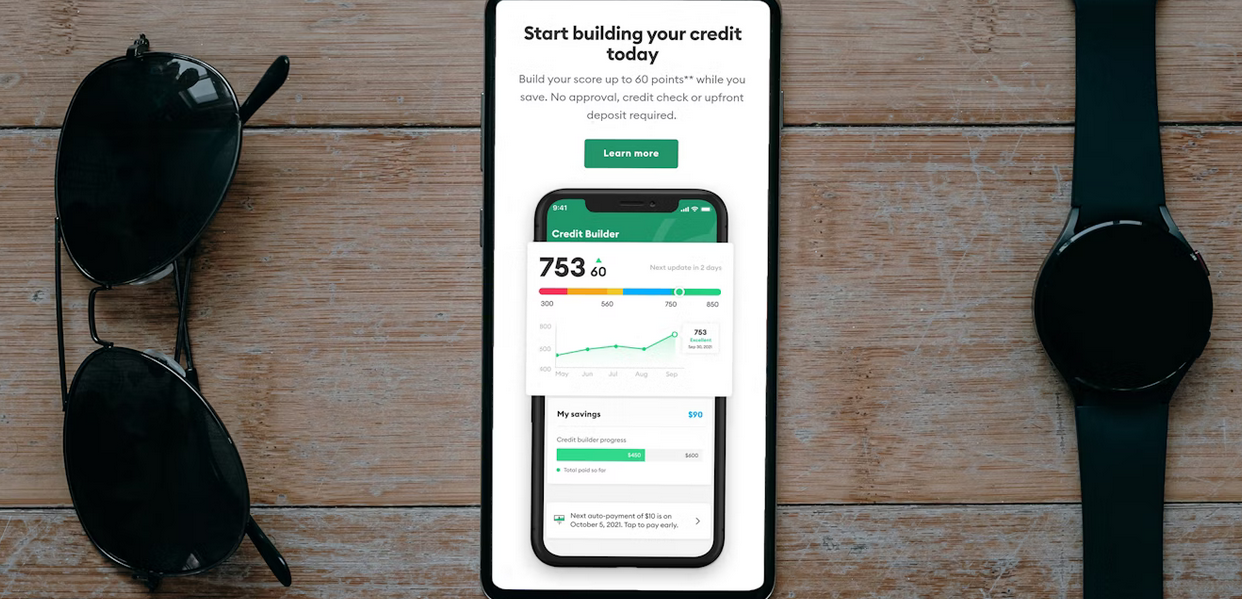

Improving your credit score might seem like a challenge, but credit cards can actually be one of the simplest tools to help you do just that—if used responsibly. Rather than fearing them, learning how to manage your cards wisely can gradually boost your score and unlock better financial opportunities. Many people misunderstand how credit cards affect their credit standing, leading to habits that do more harm than good. In this guide, we’ll outline five practical and effective strategies you can apply today using your credit card. These methods are not complicated, but they require consistency and self-control. By building better habits around your card usage, you’re not just maintaining your credit—you’re actively improving it over time.

Always Pay on Time—No Exceptions

One of the most important things you can do to improve your credit score using a credit card is to make every payment by the due date. Payment history has a significant portion of your credit score, and one missed payment can set you back for months. Late payments can stays on your credit report for years. Setting automatic payments to cover at least the minimum amount due can prevent accidental delays. Additionally, many credit card apps now allow you to set payment reminders or notifications to help stay ahead. While it’s ideal to pay off your full balance, even minimum payments made on time count in your favor.

Keep Your Credit Utilization Low

Credit utilization is a portion of the credit limit you’re using. If your card has a limit of $1,000 and you routinely carry a $900 balance, this can signal risk to lenders—even if you pay it off. A smart rule is to stay below 30% of your credit limit. In fact, the lower your utilization, the better your score tends to respond. So if you don’t need to carry a high balance, don’t. Consider paying your bill multiple times a month or making an extra payment before the statement date to reflect a lower usage.

Don’t Close Old Accounts Too Soon

While it might seem tempting to close out unused or old credit cards, doing so can hurt your credit score by lowering your total available credit and shortening your credit history. The length of your credit history matters—a longer credit timeline reflects positively on your score. Even if you’re no longer using an old card frequently, keeping it open with the occasional small purchase (paid off quickly) can help support your credit profile. Just be cautious of annual fees; if your old card has one and offers no benefits, consider calling the issuer to downgrade it to a no-fee version instead of closing it outright.

Diversify the Types of Credit You Use

Although credit cards are a great start, using a mix of credit types—such as installment loans or retail accounts—can further strengthen your credit score. This doesn’t mean rushing out to take on debt. But if you’re planning to make a large purchase, such as financing a computer or appliance, consider using a structured loan if it fits your budget. Having both revolving (like credit cards) and installment credit demonstrates that you can handle different kinds of financial obligations, which can gradually nudge your credit score upward.

Review Your Credit Report Regularly

Many consumers never check their credit reports, which is a mistake. Errors can appear that unfairly lower your score, and unless you spot them, they’ll stay there. Obtain a free annual credit report from official sources and review it for accuracy—check your personal details, account information, and payment records. If something doesn’t look right, dispute it promptly. Fixing errors can lead to a quick bump in your credit score. Also, reviewing your report gives you an idea of how your current habits are reflected in your credit profile—helping you course-correct if needed.

Credit cards are effective at building and improving your credit score—but they demand thoughtful handling. By focusing on timely payments, keeping balances low, preserving older accounts, maintaining credit variety, and checking your reports for mistakes, you can create a healthier credit profile over time. These strategies aren’t about tricks or shortcuts—they’re grounded in smart financial behavior that lenders reward. Whether you’re just starting your credit journey or looking to recover from past missteps, your credit card can help steer you in the right direction—one payment at a time.…

Read More

Simple Hacks to Take Your Credit Card Rewards to the Next Level

- by Benjamin Garza

- 3 years ago

- 0 comments

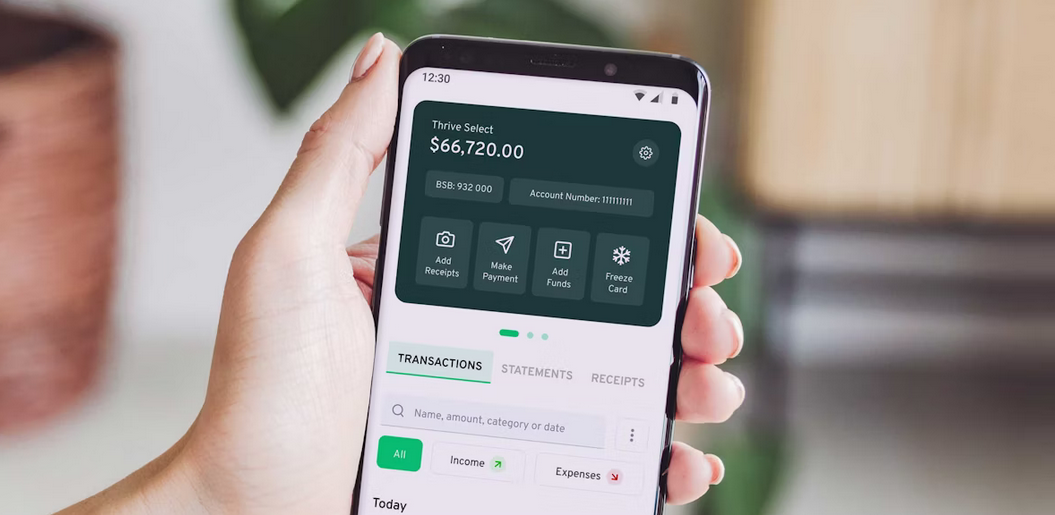

Juggling with kids while working at home and managing the finances – all at the same time is a challenge for anyone. But hey, busy moms! Did you know that those credit card(s) that are tucked away in your wallet can help you get rewards and more? Yes, that’s right. With the bästa kreditkortet or credit card reward programs, you can get money back on all of your purchases, as well as special discounts and deals.

The banks and issuers of these cards provide cash rewards, airline miles, points for shopping, gift certificates, and more for using the card. Now let me ask you a question. Are you ready to max out the rewards and get the most bang for your buck? So read on for some simple hacks that can help you do just that.

Consider Going for a “Product Change”

First off, let’s evaluate how much you are getting from your current credit card. Is it enough? If not, why not consider doing a “product change” – changing the type of credit card you currently have? Many banks and issuers run special campaigns offering higher reward points on various types of cards like travel, gas, dining, and so on. Do your research and find out which card will provide you with the best rewards. Without applying for a new card, you can get more rewards by doing a product change.

Ask for a Retention Offer

Have you noticed that some of your cards have been sitting idle in your wallet? It may be time to call the issuer and ask for a retention offer. Many banks will give bonus points, rewards, or discounts if you start using their card again. This will be such a great opportunity to get the most out of your card and enhance your rewards. Just be sure to read the fine print and ask questions if needed.

Be Aware of the Credit Card Calendar

The credit card market is constantly evolving. They have great offers and rewards points that can be availed during different times of the year. For example, banks usually come out with special campaigns around holidays such as Christmas and Thanksgiving. Doing your due diligence to keep up with the ever-changing promotions will help you get more rewards points and discounts on all your purchases.

Pay Attention to the Bank’s Promotions

Banks and credit card issuers often come up with new promotions that can help you maximize your rewards points. They may offer discounts on certain products or services, bonus points for a specific purchase amount, cash back offers, and so on. So make sure to read their emails, flyers, and other materials to know what they are offering, and take advantage of the same. In some cases, you may even be eligible for additional rewards and discounts – so don’t miss out on those opportunities.

Finally, make sure you use your credit card responsibly. Pay off your balance in full each month to avoid carrying debt or paying interest. This way, you’ll be able to maximize your reward points and get more out of them. With these simple hacks, you can take your credit card rewards to the next level and get the most bang for your buck. So moms, get outside your comfy zone and make the most of your card.…

Read More