Author: Emilie Albury

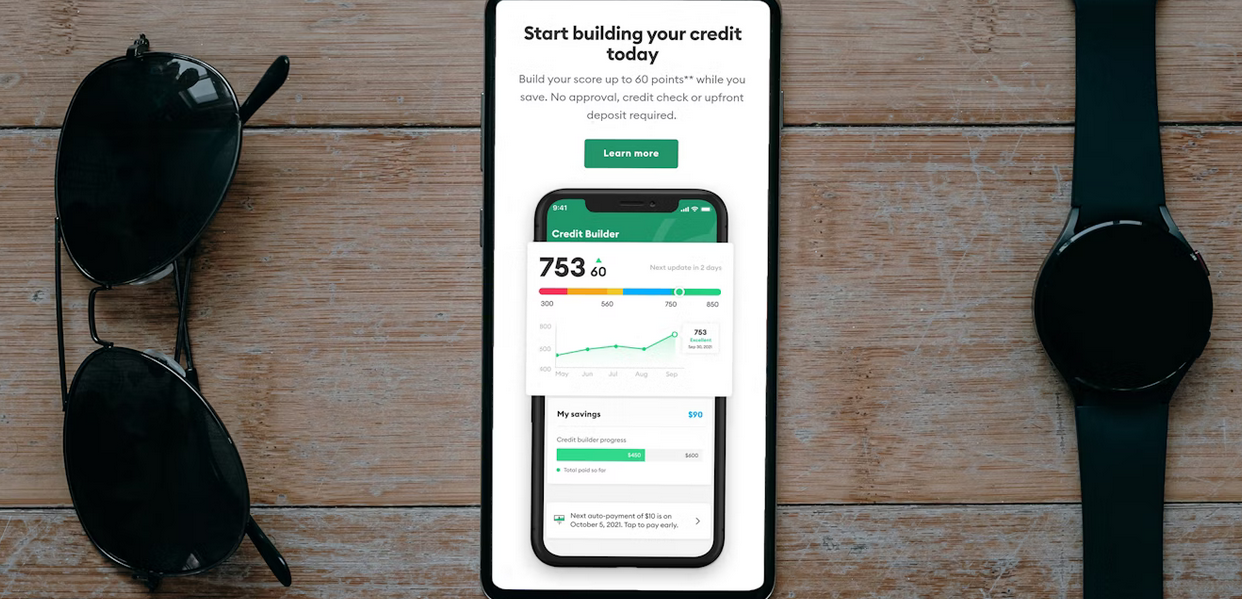

How to Improve Your Credit Score Using Credit Cards

- by Emilie Albury

- 6 months ago

- 0 comments

Improving your credit score might seem like a challenge, but credit cards can actually be one of the simplest tools to help you do just that—if used responsibly. Rather than fearing them, learning how to manage your cards wisely can gradually boost your score and unlock better financial opportunities. Many people misunderstand how credit cards affect their credit standing, leading to habits that do more harm than good. In this guide, we’ll outline five practical and effective strategies you can apply today using your credit card. These methods are not complicated, but they require consistency and self-control. By building better habits around your card usage, you’re not just maintaining your credit—you’re actively improving it over time.

Always Pay on Time—No Exceptions

One of the most important things you can do to improve your credit score using a credit card is to make every payment by the due date. Payment history has a significant portion of your credit score, and one missed payment can set you back for months. Late payments can stays on your credit report for years. Setting automatic payments to cover at least the minimum amount due can prevent accidental delays. Additionally, many credit card apps now allow you to set payment reminders or notifications to help stay ahead. While it’s ideal to pay off your full balance, even minimum payments made on time count in your favor.

Keep Your Credit Utilization Low

Credit utilization is a portion of the credit limit you’re using. If your card has a limit of $1,000 and you routinely carry a $900 balance, this can signal risk to lenders—even if you pay it off. A smart rule is to stay below 30% of your credit limit. In fact, the lower your utilization, the better your score tends to respond. So if you don’t need to carry a high balance, don’t. Consider paying your bill multiple times a month or making an extra payment before the statement date to reflect a lower usage.

Don’t Close Old Accounts Too Soon

While it might seem tempting to close out unused or old credit cards, doing so can hurt your credit score by lowering your total available credit and shortening your credit history. The length of your credit history matters—a longer credit timeline reflects positively on your score. Even if you’re no longer using an old card frequently, keeping it open with the occasional small purchase (paid off quickly) can help support your credit profile. Just be cautious of annual fees; if your old card has one and offers no benefits, consider calling the issuer to downgrade it to a no-fee version instead of closing it outright.

Diversify the Types of Credit You Use

Although credit cards are a great start, using a mix of credit types—such as installment loans or retail accounts—can further strengthen your credit score. This doesn’t mean rushing out to take on debt. But if you’re planning to make a large purchase, such as financing a computer or appliance, consider using a structured loan if it fits your budget. Having both revolving (like credit cards) and installment credit demonstrates that you can handle different kinds of financial obligations, which can gradually nudge your credit score upward.

Review Your Credit Report Regularly

Many consumers never check their credit reports, which is a mistake. Errors can appear that unfairly lower your score, and unless you spot them, they’ll stay there. Obtain a free annual credit report from official sources and review it for accuracy—check your personal details, account information, and payment records. If something doesn’t look right, dispute it promptly. Fixing errors can lead to a quick bump in your credit score. Also, reviewing your report gives you an idea of how your current habits are reflected in your credit profile—helping you course-correct if needed.

Credit cards are effective at building and improving your credit score—but they demand thoughtful handling. By focusing on timely payments, keeping balances low, preserving older accounts, maintaining credit variety, and checking your reports for mistakes, you can create a healthier credit profile over time. These strategies aren’t about tricks or shortcuts—they’re grounded in smart financial behavior that lenders reward. Whether you’re just starting your credit journey or looking to recover from past missteps, your credit card can help steer you in the right direction—one payment at a time.…

Read More

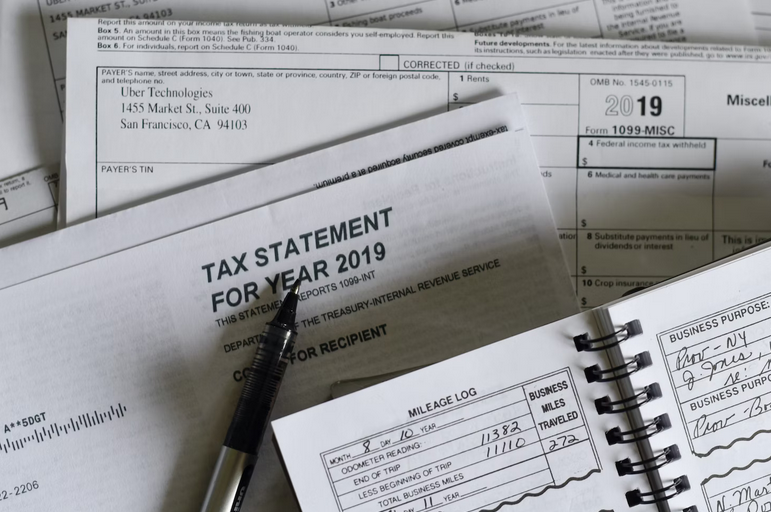

Understanding Tax Debt Resolution: The Role of IRS Tax Relief Programs

- by Emilie Albury

- 2 years ago

- 0 comments

Tax debt can be a daunting burden for individuals and businesses alike, leading to financial stress and uncertainty. However, the Internal Revenue Service offers an IRS forgiveness program designed to help taxpayers resolve their tax debt and regain financial stability. In this article, we will explore these IRS tax relief programs and their vital role in assisting taxpayers in times of financial hardship.

Offer in Compromise (OIC)

The Offer in Compromise program is one of the most well-known IRS tax relief programs. It allows eligible taxpayers to settle their tax debt for less than the full amount owed. To qualify, you must demonstrate that paying the full amount would cause financial hardship or be unjust. The IRS considers factors such as your income, expenses, assets, and ability to pay.

Installment Agreements

Installment agreements provide taxpayers with a structured plan to pay off their tax debt over time. These agreements allow you to make regular monthly payments, making it easier to manage your financial obligations. The IRS offers various types of installment agreements, depending on the amount you owe and your financial situation.

Innocent Spouse Relief

Innocent Spouse Relief is designed to protect individuals who may be held responsible for their spouse’s tax debt. If you can prove that you had no knowledge of your spouse’s tax errors or omissions, you may qualify for relief. This program helps innocent spouses avoid unfair tax liability.

Currently Not Collectible (CNC) Status

If you are facing financial hardship and cannot afford to pay your tax debt, you may be eligible for Currently Not Collectible status. This temporarily suspends IRS collection efforts until your financial situation improves. While in CNC status, the IRS will not attempt to collect the debt but may still accrue penalties and interest.

Tax Liens and Levies Resolution

IRS tax relief programs also address tax liens and levies. A tax lien is a legal claim against your property, while a levy allows the IRS to seize your assets to satisfy a tax debt. The IRS offers options to release or remove tax liens and stop levies, such as entering into an installment agreement or demonstrating financial hardship.

Fresh Start Initiative

The Fresh Start Initiative is a collection of IRS tax relief provisions designed to make it easier for individuals and businesses to resolve their tax debt. It includes more flexible criteria for Offer in Compromise, streamlined installment agreements, and increased thresholds for tax liens.

Tax Relief for Disaster Victims

In times of natural disasters, the IRS provides special tax relief programs for affected individuals and businesses. This relief may include extended filing deadlines, penalty waivers, and assistance in reconstructing lost tax records.

IRS tax relief programs play a crucial role in helping taxpayers resolve their tax debt and regain financial stability. Whether you are struggling with a substantial tax debt or facing unexpected financial challenges, it’s essential to explore the options available to you. Consulting with a tax professional or seeking assistance from the IRS can help you determine the best course of action for your specific situation. Remember that proactive communication with the IRS is often the first step toward finding a suitable tax debt resolution plan.…

Read More

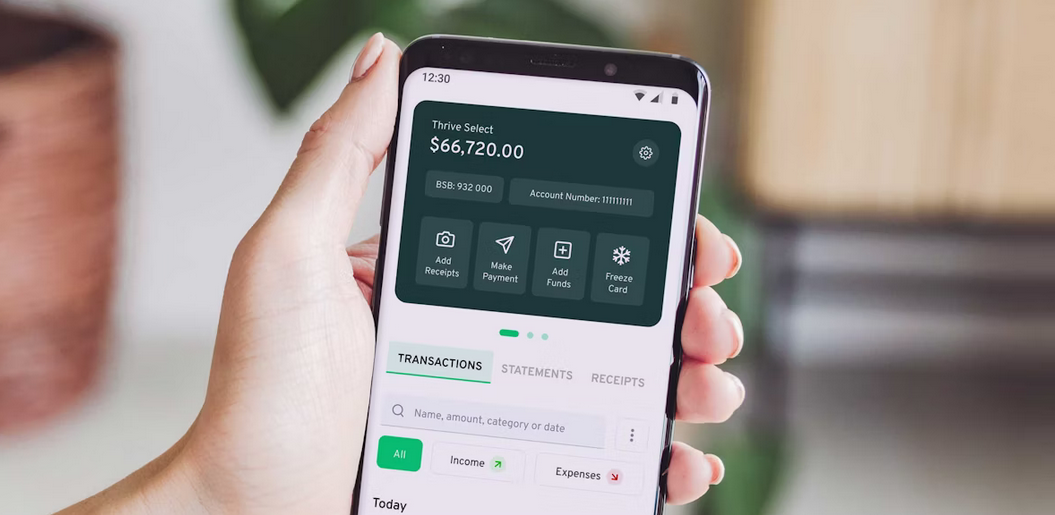

Are You Looking for an Online Accounting Firm? Here is a Guide

- by Emilie Albury

- 4 years ago

- 0 comments

Accounting is essential for any business to succeed financially. There has been an increasing number of companies that are outsourcing their accounting service to online accounting firms. If you are new to the whole concept of online accounting firms, these are businesses that offer accounting services to other enterprises at a fee.

Although there are becoming popular, there are many who are yet to give them a try. It is essential to note that many benefits have been attributed to hiring services offered and other similar enterprises. Some of the benefits you will gain once you hire an online accounting firm include increased productivity and reduced operational costs as you will not have to hire a full-time accountant.

Since you know some of the benefits credited to online accounting services, you may be thinking of hiring an accounting firm. Here are some of the important factors you should consider when picking an online accounting firm.

The Recommendations

The first factor that will be essential in helping you make the right choice when choosing an online accounting firm is recommendations. As stated earlier in the article, many enterprises are hiring online accounting firms because of the benefits they bring to the table. With that said, there is a high chance you know many people who have hired an online accounting firm before.

The first factor that will be essential in helping you make the right choice when choosing an online accounting firm is recommendations. As stated earlier in the article, many enterprises are hiring online accounting firms because of the benefits they bring to the table. With that said, there is a high chance you know many people who have hired an online accounting firm before.

Asking for recommendations will be vital in helping you find a reliable online accounting firm. If you cannot get good recommendations from those close to you, you should consider reading online reviews and comments about the best online accounting firms.

The Qualification

The second important factor you should consider when looking for the right online accounting firm is qualification. Like other professions, there are many qualifications required for anyone to be good at accounting. You should ensure that the online accounting firm you select has employed accountants who are fully qualified to offer accounting services to your business.

The second important factor you should consider when looking for the right online accounting firm is qualification. Like other professions, there are many qualifications required for anyone to be good at accounting. You should ensure that the online accounting firm you select has employed accountants who are fully qualified to offer accounting services to your business.

Apart from the type of qualifications an online accounting firm has, it will be essential to consider an online accounting firm’s license. A suitable online accounting firm should have a license that is recognized by the right accounting bodies.

There are a lot of benefits that have been credited to hiring an online accounting firm. It is essential to point out that not all online accounting firms will be ideal for your business. You need to ensure that you consider the information mentioned in the article to choose the right online accounting service.…

Read More

Why Personal Financial Planning is Important

- by Emilie Albury

- 5 years ago

- 0 comments

If you are not prepared, there are a ton of surprises involving finances you can encounter, which eventually can overwhelm you. It can be school fees, medical bills, or even car issues. That is why personal financial planning is vital as it helps you plan both your current and future lifestyle.

You can either develop your financial plan or seek professional financial services from qualified financial advisors. A detailed financial plan guides you on various financial investments like budgeting, insurance, investing, savings, and any other thing that involves finances.

Here is why personal financial planning is crucial.

Budgeting Your Money

As stated above, you can get a lot of financial surprises if you are not adequately prepared. You need to effectively budget your income to cover your monthly expenses and remain with a reserve that will cover any future or unexpected financial emergencies. That is where personal financial planning comes in.

As stated above, you can get a lot of financial surprises if you are not adequately prepared. You need to effectively budget your income to cover your monthly expenses and remain with a reserve that will cover any future or unexpected financial emergencies. That is where personal financial planning comes in.

It helps you create a spending plan for each month, but you should also make sure you implement the budget. Having a budget with a professional’s touch from a qualified financial planner allows you to make well-informed personal financial decisions. It gives you a clear insight into the things you should spend on and the things to avoid.

Help to Measure Your Progress on Financial Goals

The main essence of coming up with a personal financial plan is because you have financial goals you intend to meet. You cannot set these goals without creating a financial plan first. However, you should ensure that your goals are achievable to avoid straining yourself to the extremes. You can set aside a specific amount of money monthly to contribute to a savings plan or repaying a loan. You can quickly achieve your targets with a financial plan in place as it gets you to be more disciplined financially.

Expense Cutting

One of the primary reasons why people often have financial troubles is because of impulsive buying. You see an item you like, buy it immediately and forget that you had a debt to settle or a savings plan to adhere to. Creating a personalized financial plan helps you develop a budget that, if adhered to, helps cut down on unnecessary expenses. The plan gives details on how you can spend your money and how you can also save for your future.

You get to identify the essential expenses but also but a small budget aside for entertainment purposes. The remainder can be set aside as saving for future financial needs or any financial emergencies.…

Read More